On March 23, the Federal Trade Commission proposed a “click to cancel” provision requiring sellers to make it as easy for consumers to cancel their enrollment as it was to sign up.

That is just one of several significant updates the Commission is proposing to its rules regarding subscriptions and recurring payments.

The notice was published April 24 in the Federal Register. Consumers can submit comments online at www.regulations.gov

by June 23. Put Negative Option Rule; Project No. P064202 in the subject line.

“Some businesses too often trick consumers into paying for subscriptions they no longer want or didn’t sign up for in the first place,” said FTC Chair Lina M. Khan. “The proposed rule would require that companies make it as easy to cancel a subscription as it is to sign up for one. The proposal would save consumers time and money, and businesses that continued to use subscription tricks and traps would be subject to stiff penalties.”

The notice of proposed rulemaking is part of the FTC’s ongoing review of its 1973 Negative Option Rule, which the agency uses to combat unfair or deceptive practices related to subscriptions, memberships, and other recurring-payment programs.

The current patchwork of laws and regulations available to the FTC do not provide consumers and industry with a consistent legal framework. Accordingly, the proposal would make several specific changes, including implementing:

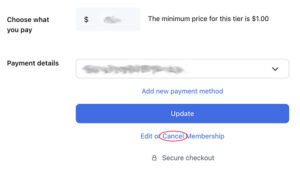

- A simple cancellation mechanism: If consumers are unable to easily leave any program when they want to, the negative option feature becomes nothing more than a way to continue charging them for products they no longer want. To address this issue, the proposed rule would require businesses to make it at least as easy to cancel a subscription as it was to start it. For example, if you can sign up online, you must be able to cancel on the same website, in the same number of steps.

- New requirements before making additional offers: The proposed rule would allow sellers to pitch additional offers or modifications when a consumer tries to cancel their enrollment. But before making such pitches, sellers must first ask consumers whether they want to hear them. In other words, a seller must take “no” for an answer and upon hearing “no” must immediately implement the cancellation process.

- New requirements regarding reminders and confirmations: The proposed rule would require sellers to provide an annual reminder to consumers enrolled in negative option programs involving anything other than physical goods, before they are automatically renewed.

The Commission vote approving publication of the notice of proposed rulemaking was 3-1, with Commissioner Christine S. Wilson voting no. Chair Khan issued a separate statement, in which she was joined by Commissioners Rebecca Kelly Slaughter and Alvaro Bedoya.

Commissioner Wilson issued a dissenting statement saying the proposed rule was too broad and would apply to any marketing claims that were untrue.

The FTC has developed a fact sheet at www.ftc.gov/system/files/ftc_gov/pdf/NegOptions-1page.pdf summarizing the proposed changes to the Negative Option Rule.

The primary staffer on this matter is Hampton Newsome in the FTC’s Enforcement Division