By Ron Kustek

It took a while to come up with making a comparison between business owner groups without having any judgements or connotations associated with either grouping. So, please bear with me as we try to address an issue facing our entire orchard, which is our Santa Cruz community.

Let’s say that the “apples” are those business owners who own residential rental properties, and the “oranges” are the group of businesses (restaurants, shops) who employ people who live in the area and rent instead of own their home. Again, our orchard is our entire Santa Cruz community.

Whether you’re an “apple” or an “orange” business, you’re managing your sales revenues vs. your expenses to reach an overall profit you want. However, looking only at yourself ignores the inter-dependency of how our orchard of both “apple” and “orange” businesses can each profitably grow together.

Chase(1) says: “A popular standard for budgeting rent is to follow the 30% rule, where you spend a maximum of 30% of your monthly income before taxes (your gross income) on your rent. This has been a rule of thumb since 1981, when the government found that people who spent over 30% of their income on housing were “cost-burdened.”

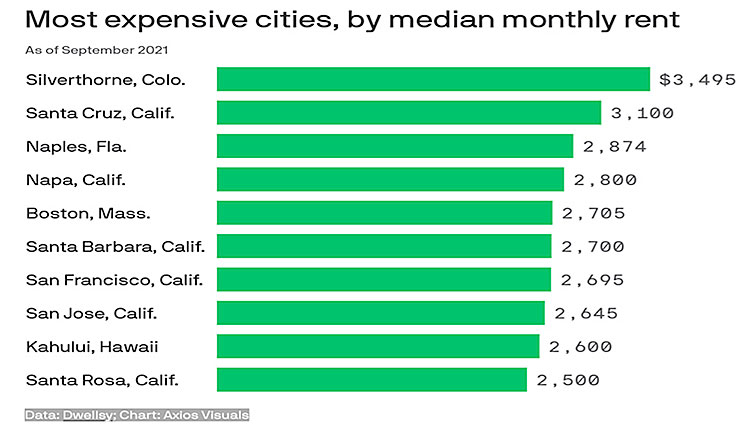

Santa Cruz was just highlighted as the 2nd most expensive place to live in the entire United States — more expensive than San Francisco or Kahului, Hawaii, with our median monthly rent of $3,100:

This means that an “orange” business (who is not a residential property-renting business) needs to pay EACH employee a MINIMUM MONTHLY SALARY of $7,750 (at 40%) or $10,333 (at 30%) — just for a single employee to be able to affordably live in the orchard of Santa Cruz.

That means for just ONE employee to provide for themselves and/or their family, they would have to be paid $93,000 to $124,000/year!

The majority of “orange” business owners may not even be making this amount for themselves let alone be able to pay every one of their employees $93,000 to $124,000/year!(2)

So — for all the “apple” business owners of rental properties who believe that they can ‘”charge what the market will bear” just because they can, then how will the entire orchard of Santa Cruz prosper — BOTH “apples” and “oranges” — together?

Just because you ‘can’ charge higher rents, does that mean you should charge higher rents, if that means that by doing so you’re contributing to both a labor shortage as well as an unrealistic payroll expense for our “orange” businesses?

There is not an easy answer, but we have this moment to reconsider the role that both “apples” and “oranges” play in business, but more importantly, how they impact each other in the orchard we’re supposedly cultivating together here in Santa Cruz.

•••

Ron Kustek is a former senior executive at The Coca-Cola Company and small business entrepreneur currently teaching at Cabrillo College. Reach him at rokustek@cabrillo.edu

~~~

- https://www.chase.com/personal/banking/education/budgeting-saving/how-much-income-should-go-to-rent

- OK, if you’re only employing a 2-income/2-wage earning family member, then dividing in half means a business needs to then pay each employee $46,500 to $62,000 a year.