By Jondi Gumz

When Santa Cruz County Bank has taken pride in being a local community bank for 20 years, why would the bank leaders agree to a $63 million merger with First Capital Bank, headquartered in Salinas?

Santa Cruz County Bank is bigger — $1.7 billion in asset, loans of $1.4 billion and deposits of $1.5 billion — compared to First Capital — assets of $1 billion, loans of $600 million and deposits of $900 million.

Santa Cruz County Bank has more employees — 140 — compared to First Capital, which has 100.

Santa Cruz County Bank, founded in 2004, is a bit older compared to First Capital, founded in 2007.

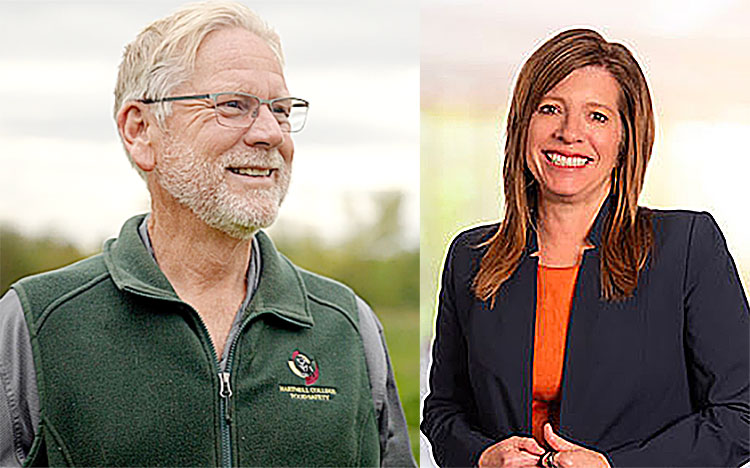

The answer, according to Santa Cruz County Bank CEO and President Krista Snelling, who will lead the merged bank, is regulatory expenses.

In a press conference Monday, she said, “The regulatory environment is getting tougher.”

With two banks joined together, those regulatory expenses will be paid once, not twice.

What will the name of the merged bank be?

That is to be determined, but Snelling pointed out, “We are the surviving legal entity.”

A fine point you may not know: Santa Cruz County Bank has a holding company called West Coast Community Bank.

The headquarters will remain in Santa Cruz, and First Capital’s administrative office will remain in Salinas.

The merged bank’s board will expand from eight to 10, and Kurt Gollnick, a retired winery executive, and Dr. Daniel Hightower, chairman and vice chairman respectively of First Capital, will fill those seats, with Gollnick as vice chairman.

Territory Overlap

Snelling conceded there is territory overlap, with Santa Cruz County Bank’s branches in Salinas and Monterey fairly close to First Capital’s branches in Salinas and Monterey.

First Capital has a branch in Santa Cruz at 3110 Mission Drive and Santa Cruz County Bank’s headquarters is three miles away.

So decisions will be made about which locations to keep.

Will there be layoffs?

Snelling concedes there will be some duplicated positions, but it’s too early to tell.

“We don’t know,” she said.

Some territory is not duplicated.

Santa Cruz County Bank has an office in Silicon Valley, Cupertino, across from Apple, thanks to its acquisition of locally owned Lighthouse Bank.

In fiscal 2023, Santa Cruz County Bank made 23 SBA loans totaling $22.58 million in Silicon Valley (Santa Clara, Santa Cruz, and Monterey counties), earning the No. 1 ranking for number of loans and No. 3 for dollar volume of SBA loans.

First Capital has offices in King City and San Luis Obispo, where Santa Cruz County Bank has not been active.

Sam Jimenez, the president and CEO, said in a statement “the merger allows us to leverage our combined resources more effectively.”

Higher Loan Limit

What’s the benefit for customers? A higher loan limit: $80 million to a single borrower, instead of $60 million, Snelling said.

While San Francisco is seeing billions in loans on commercial real estate coming due on empty high-rise offices as people work from home and empty stores as people shop from home, that is not the case in Santa Cruz. Some San Francisco borrowers have asked lenders for extensions.

Snelling said Santa Cruz County Bank has “not a single loan with a problem.”

Asked who made the overture for the merger, she said it was “mutual.”

Some employees have worked for the other bank, and some are related, she said.

The benefit she sees is bringing together two banks with similar business models.

“What we liked most was their responsibility to serving the community,” she said.

Asked to name Santa Cruz County Bank’s biggest accomplishment, she said the 573 Paycheck Protection loans extended during the pandemic to save 50,000 jobs.

The boards of directors have given their OK. Shareholders and regulators must approve.

Regulators look at the community reinvestment rating. Santa Cruz County Bank’s is outstanding. First Capital’s is satisfactory.

The merger is an all-stock transaction, paying $10.78 for each FISB share of stock, based on Santa Cruz County Bank stock price of $29.94.

Shareholders of FISB stock are expected to receive .36 shares of SZCZ stock in exchange for each share of FISB stock.

Snelling expects the transaction to close in the fourth quarter, October or thereafter.

A system conversion is required and that will take two to six months.