By Jondi Gumz

Insurance Commissioner Ricardo Lara wants to bring insurers back to California but that doesn’t mean relief on rates.

“Prices are high because options are few,” said Amy Bach, founder of the nonprofit United Policyholders.

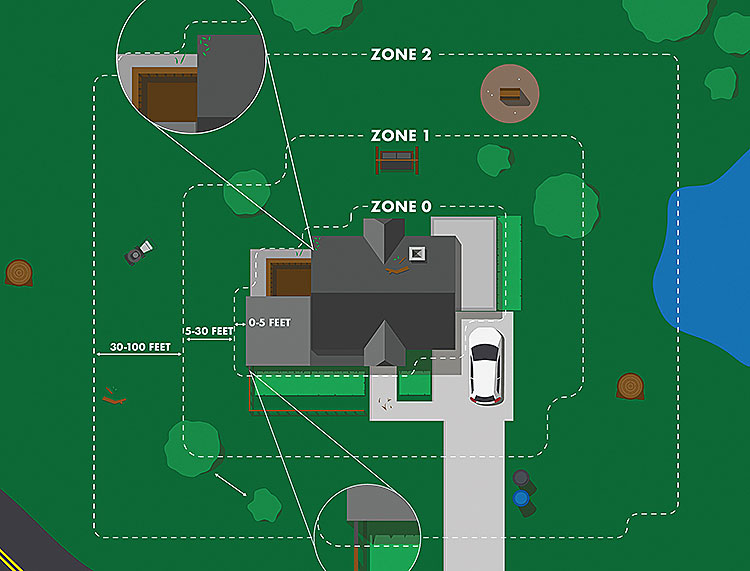

CalFire Deputy Chief John Morgan wants homeowners to create “defensible space” in the 30 feet next to your home to give firefighters a buffer to do their work.

CalFire Deputy Chief John Morgan wants homeowners to create “defensible space” in the 30 feet next to your home to give firefighters a buffer to do their work.

The insurance commissioner said defensible space efforts “should be considered in insurance pricing but that doesn’t happen.”

He acknowledged that many retirees can’t afford to “harden” their homes against wildfire.

That’s the state of home insurance in California from three top experts convened for a Zoom call April 3 by Assembly Member Gail Pellerin.

Lara has 10 sponsored bills in the Legislature aimed at improving the insurance situation. Here are three:

California Safe Homes Act (authored by Assembly Member Lisa Calderon) This legislation would provide state-tax-free funds (up to $10,000) to help residents purchase fire-rated roofs and develop non-ignition zones around their properties. These initiatives seek to safeguard lives and homes while enhancing eligibility for insurance discounts.

The act would establish a grant program at the Department of Insurance, using existing funds without incurring additional costs to taxpayers—similar to current programs in other states that address windstorm threats.

The grants would be federal-tax-free if Congress passes the bipartisan “Disaster Resiliency and Coverage Act,” which has received support from the Commissioner and many members of California’s congressional delegation.

California Community Fire Hardening Commission Act (authored by Senators Susan Rubio, Dave Cortese, and Henry Stern) Proposes the creation of an independent statewide commission within the Department of Insurance to develop a more effective inspection system enabling individuals to receive insurance discounts for home hardening for wildfire safety.

The commission will review lessons learned from recent wildfires and offer recommendations to enhance and expedite home and community hardening efforts.

Eliminate “The List” Act (authored by Senator Ben Allen) This bill requires insurance companies to pay wildfire survivors 100% of their contents coverage without needing a detailed inventory list.

It also grants consumers at least 180 days to provide proof of loss to their insurance company following a declared state of emergency.

Read about more legislation at www.insurance.ca.gov/0400-news/0100-press-releases/2025/release017-2025.cfm

In 2024, Allstate said it would resume writing policies in California once regulatory changes allow catastrophe modeling and incorporate the net cost of reinsurance into rates.

Not all the reforms are in place yet; Lara is meeting with reinsurers.

The insurance commissioner set listeners straight on the FAIR Plan: It’s run by insurance companies sharing the risk, not the government, but the insurance commissioner has authority over its operations.

Bach advised homeowners to work with experienced broker to find insurance coverage, even a “non-admitted” brand you’ve never heard of.

If you are not renewed, you get 75 days to find new coverage.

“You need an agent hustling to find a company,” Bach said. “Doing what you can to reduce risk is critical.”

Insurers are going high tech, using artificial intelligence, aerial images, and data mining to assign a risk score to your home.

“You have the right to appeal if the insurer is incorrect,” Bach said.

If you end up on the FAIR Plan, which is the last resort and can be five times more expensive, you’ll need a second policy to cover more than fire.

Bach recommends coverage of replacement value, not the purchase price.

“Price, I know it’s painful,” she said.

Ways to reduce the cost: Bundle auto insurance with home insurance or raise the deductible to as high as $10,000 or $20,000. This means with any loss you claim for, you will pay the deductible before coverage kicks in.

See buying tips at https://uphelp.org/ under Get Prepared.

Morgan said replacing a combustible roof is “not low cost but very effective.”

He also recommends changing out combustible siding, removing wooden fences that can bring fire up against your home, and replacing bark and mulch with gravel.

•••

CalFire has a defensible space quiz that sends you a report on things you can do. See www.Fire.ca.gov

Morgan also recommends: https://readyforwildfire.org/prepare-for-wildfire/defensible-space/